… pretty soon it starts to add up to real money! On Tuesday last week, Finance Minister Katrine Conroy presented the 2023 BC budget, the first budget under new Premier David Eby. The scope of the announcements were significant and addressed many pressing matters including health care, mental health and addictions, aid to affordability, and climate, noting a particular focus on housing, with over $4.2 billion in funds being directed to the creation of more housing supply over the next three years.

Much of this spending stems from the intent of the BC government to utilize much of the $6 billion budget surplus that this administration has amassed and is now applying to address many long-standing commitments and, as in the case of health care and housing, critical needs. “It’s just not the right time to start making cuts, … It’s not the right time to start making people pay out of pocket for services they expect,” said Minister Conroy.

Per CHBA-BC CEO Neil Moody who was in the budget lock-up on Tuesday, and who together with the input from members from local and provincial GR committees had earlier submitted budget recommendations to the Ministry of Finance: “This budget signals that the BC government is serious about removing the barriers and red tape fueling the housing shortage that exists in the province. We’re encouraged by the recent announcements related to housing being magnified by what we see in the 2023 BC Budget today.”

It is indeed encouraging to see initiatives in this budget support the housing related announcements made by Premier Eby and Housing Minister Ravi Kahlon since December 2022 such as the Housing Supply Act and the Growing Community Fund, and we are seeing tangible evidence of a commitment within a number of provincial ministries to address provincial approval backlogs, and expedite the process with the “One Window” approach that we hear will be “live” in the spring of this year.

Highlights of key budget announcements pertaining to housing are:

- $2 billion in capital funding and investments towards affordable housing programs and projects.

- $1 billion for a new Growing Communities Fund.

- $91 million towards a new pilot project that financially incent homeowners to develop new secondary suites for long-term rental opportunities.

- $77 million to speed up natural resource permitting and modernize the permitting service delivery model, like the Permitting Strategy for Housing and Housing Action Task Force.

- $57 million to create more homes through new residential zoning measures and by reducing the time and cost associated with local government approval processes.

- $11 million that will help implement the Housing Supply Act: and,

- New property transfer tax incentive to encourage the construction of new purpose-built rentals.

The details of the proposed spending relative to housing and infrastructure are summarized by our CHBA-BC colleagues, and cover the capital and infrastructure spending, and funding for incenting secondary suites, the Housing Supply Act, the Rapid Housing Initiative, land acquisition near transit lines for housing, supporting BC Builds and Building BC programs, skills development and training, expediting provincial approvals, and a number of tax measures and renters tax credit. Please review to gain an understanding of how broad these measures to support housing are and how members can seek to participate and or benefit.

Growing Communities Fund

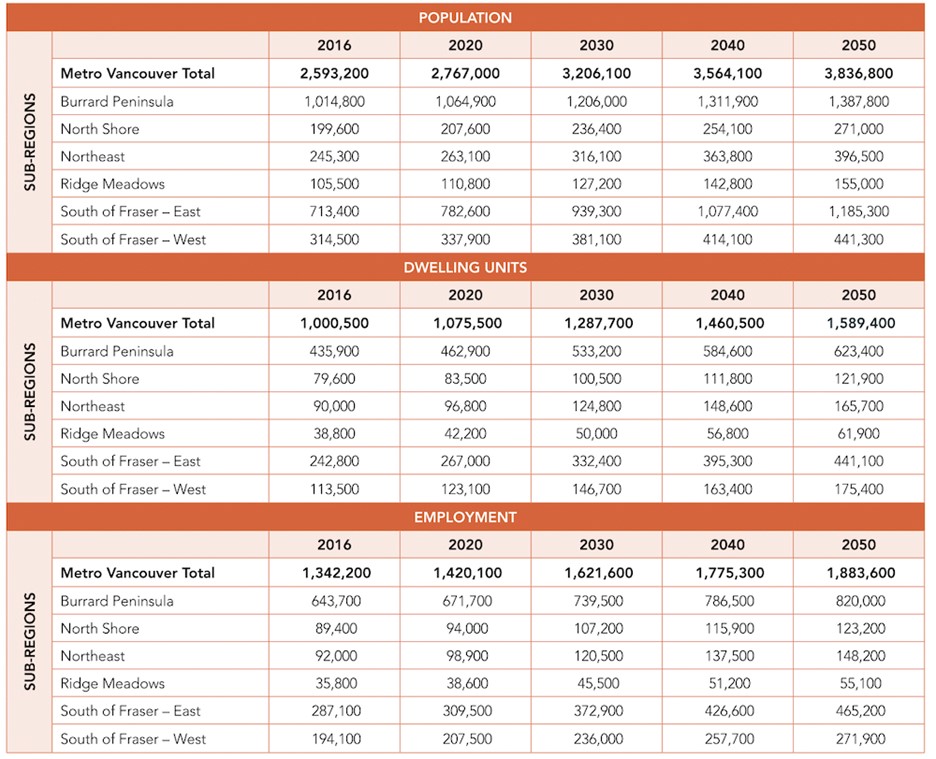

With a $1 billion price tag the budget will be funding the Growing Communities Fund (GCF) with monies being allocated to all 188 BC municipalities through a formula that reflects population size and growth. Per Premier Eby, “ Our communities are growing and this puts more pressure on community centres, parks and swimming pools that families rely on. To help, we’re providing the single largest provincial investment in communities in B.C.’s history” Minister of Municipal Affairs Ann Kang notes, “I know that our local governments are working hard to keep up with the growing demands of their communities … These grants will support projects that each community needs the most, like new affordable housing and child care facilities, road improvements or recreation centres.”

The monies being offered to each municipality or regional district were summarized and can be reviewed in the table provided by GovBC, and we can see that Vancouver will receive $49 million, Surrey at $89 million, Langley District (Township) $24.3 million, Burnaby $28.7 million, Richmond $20.3 million, North Vancouver City $10.9 million, North Vancouver District, $10.2 million, Coquitlam $18.6 million, and Maple Ridge $16.5 million. It should be noted that the funds in question appear to be directed to the very elements that municipalities collect DCC’s and CAC’s for, and all of the noted municipalities have or are affecting new rates on both of those fee structures, or density bonusing with percentage increases from 25% to as high as 200%, that can reflect tens of thousands of dollars.

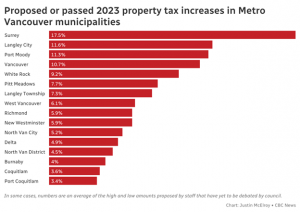

At the same time, it has been reported that Surrey is seeking a tax rate increase of 17.9% and Vancouver 10%, and it begs the question of fiscal responsibility and or effective management that are driving such large adjustments which will inevitably have an effect on affordability.

The CBC Metro Matters column notes Port Coquitlam’s tax rate increase is the lowest in the region at 3.38% with the prevailing theory that Port Coquitlam “ … is a well-managed city focusing on basic municipal services, while Vancouver is a bloated government with too many staff and too many priorities”, and that Port Coquitlam manages their financial reserves to provide direct relief to taxpayers rather than bury the surpluses in “emergency funds” or other means to ensure retention of those funds. This table summarizes the tax increases of Metro municipalities.

The introduction of the GCF would be welcome provided the spending is in fact advanced to fund community growth, and it would also be welcome if this might offset some of the tsunamis of charges being levied by municipalities onto new residential construction. The province has indicated that the use of the funds must be reported and accounted for in their annual audited financial statements and that they will be providing additional direction on the use of these funds. When announced though, the Premier indicated that the municipalities would have the discretion to apply the funds as they see fit. So, give the municipal authorities millions of dollars of “free” money … what could go wrong?!?

|

QUICK BITES … |

|

- The Tyee offers an interesting article on how our current site-by-site approvals systems and structure for public input inhibit the process of providing more and less costly housing, “ … decisions about providing new housing are typically made on the basis of lengthy site-by-site rezoning and public hearing processes. This system of decision-making falls short on democratic grounds, and it makes building new homes more difficult and expensive for public, non-profit and private housing developers alike, contributing to the housing shortage in B.C. and Canada.” This piece suggests that public input often represents very local and vocal minority interests, and not the broader majority in the community. It reviews citywide land use planning, and the idea of “mini-publics” as a means of securing input and having the potential to have more efficient, representative, and informed public input.

- On the theme of intervention on land use and policy decisions relative to housing being administered by more senior levels of government, if and when local jurisdictions cannot move forward to achieve agreed upon targets, The Discourse Lounge reports on how 95% of the 105 San Francisco Bay area municipalities lost their zoning authority. This stemmed from the municipalities inability to break the status quo and work toward progressive and effective reforms to deliver more housing. State level authority was not imposed on those few municipalities that actually made effective changes – sounds a bit like the “stick” included in the Housing Supply Act.

- On January 1, 2023, the new federal legislation Prohibition of Residential Property by Non-Canadians Act and Regulations came into effect and as previously noted here, included a provision that the acquisition of lands for the development of residential homes by any company with more than 3% foreign ownership was prohibited. Immediately identified as an issue by CHBA National, they are “on it” and actively engaged in pushing back on this aspect of the legislation and the adverse impact on housing supply and the ability of many builders and developers from continuing doing business. Lest it is thought that this is not a big deal or “does not affect me”, please see this report from Canadian Mortgage Professionals featuring comments from economist Benjamin Tal of CIBC Capital Markets: “The damage is real – Many commercial real estate deals have been cancelled or are on hold despite the fact that they have nothing to do with residential housing. Developers that are partly foreign-owned or rely on foreign equity cannot proceed with purpose-built developments that, in our view, are the most effective tool to tackle Canada’s housing affordability crisis.”

- An interesting piece coming from McKinsey & Company from the oil and gas sector. “Climate change is here, and humanity is already grappling with its effects and taking action in all parts of the economy. As part of these efforts, the transition to a lower-carbon energy system requires urgent and fundamental shifts in how energy is produced and used the world over. Such shifts, in turn, require strategic responses from businesses.” The article covers how the oil and gas industry must participate in the energy transition and become a force in renewable energy and decarbonization. It sounds counter-intuitive but offers some compelling observations.

HAVAN continues to work with CHBA BC and CHBA to advocate for all levels of government to work together to address the challenges of the housing industry including zoning restrictions, density limits, and NIMBYism.

Looking to stay up-to-date on Metro Vancouver’s residential housing industry? Sign up for Ron’s weekly Monday Morning Briefing and other HAVAN emails here.