| 2023 had been a tough year for the construction industry and between rising construction costs, development cost charges, community amenity charges, interest rates, inflation, etc., the private sector continued to struggle to build the necessary housing supply that is being demanded by Provincial and Federal governments.

A recap. In the Spring, the provincial Housing Minister Kahlon introduced ambitious legislation to get cities to build more homes faster and targeted ten local governments on a “naughty list’ with mandates for new housing completions. Unfortunately, those communities had all recently increased their fees and charges on new residential projects, an unaffordable collision with the provincial governments housing targets and affordability. In the summer, Township of Langley proposed gross DCC increases of up to 83% on a single family home resulting in an over $40K increase on a single family home and $20,000 on a townhouse. HAVAN wrote a letter to the Inspector of Municipalities opposing the charges, which unfortunately was approved on January 19 of this year. The greatest hypocrisy is playing out at their Council table as this week as all-in stream development applications that contain single family development forms, referring the projects back to staff to work with applicants with respect to new Bill 44 density considerations. The result will be lengthy delays, increased costs and delay of new housing supply.

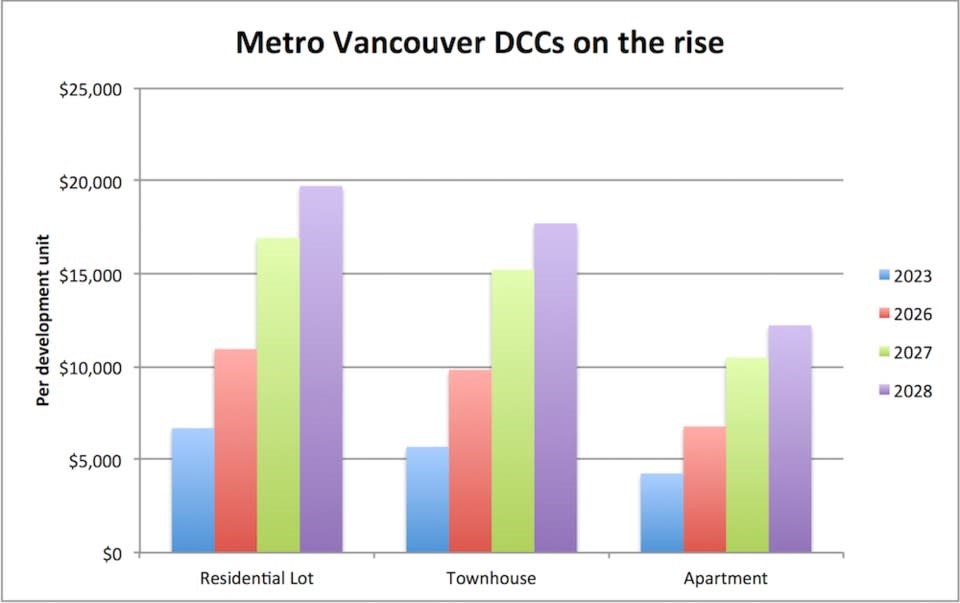

Both the Urban Development Institute and HAVAN took a research approach to examining the actual fees and charges on new construction across the region, and the province. Bottom line is that government fees and charges typically can contribute as 30% of an overall construction build. In most cases, that far surpasses what our local construction members are taking home in profit. As reported in Western Investor, in the fall Metro Vancouver approved aggressive lift to DCCs, and the introduction of a new parkland development cost charge, with a targeted increase by as much as 73% from current levels. This seemingly caught even the Federal Housing Minister off guard, who had been toiling away on determining the allocation of $4B through the government’s Housing Accelerator Fund. The Minister called out Metro Vancouver Regional District for the significant increased DCCs that seemed directly at odds with the goals of the Housing Accelerator Fund aimed at promoting construction So how is it looking in 2024? RBC Economists predicted that soaring construction costs will hamper Canada’s homebuilding ambitions while noting that housing starts were dropping to the lowest level since the pandemic. Statista Research Department reports that from 2017 to the second quarter of 2023, the construction price of residential buildings in Canada increased by 76.16%. And specifically in Toronto, the city saw second-highest building cost increase in the world, with a 40% increase between 2022 and 2023. A Toronto developer tasked his team with analyzing the impact of government fees and charges on the ability of potential homeowners to purchase a condo. The numbers speak for themselves and they are shocking as to how much government taxation is a key player in the unaffordability of condos in one of the largest cities in the Canada. And in Victoria a builder broke down the project costs into a pro-rated monthly rent payment of a two-bedroom condo to show that between CMHC and the local government, those project costs are 42% of the average rent. So how are ever-increasing costs affecting our provincial and regional governments in their ability to bring new affordable home ownership and rental projects to market? Storeys reports that BC Housing, in partnership with a local developer, recently had to cancel over 400 homes eligible for the provincial government’s Affordable Home Ownership Program (AHOP), in Surrey, as the project was no longer financially viable due to increased interest rates, construction costs and financing rates.. Most recently, Metro Vancouver Regional District had to examine the viability of two separate developments in Burnaby, providing approximately 400 non-market rental homes. Costs have increased by $109M to a new construction build cost of $215M for the two projects. The developments will go ahead with new funding to be derived from new mortgages and contributions from reserves. This begs the question…If these government projects are unviable or tenuous, even with the waiver of development fees and contribution of land, how is it expected that the private sector can build the much-needed housing supply, including affordable homes, that is being demanded of us by our local, regional, provincial and federal governments? HAVAN continues to work with CHBA BC and CHBA to advocate for all levels of government to work together to address the challenges of the housing industry including zoning restrictions, density limits, and NIMBYism. Looking to stay up-to-date on Metro Vancouver’s residential housing industry? Sign up for Ron’s weekly Monday Morning Briefing and other HAVAN emails here. |

Listen to Our Newest Podcast Episodes!