December 22, 2021

Public health measures and restrictions are mandated as of December 22, 2021.

- Indoor organized gatherings of any size are not allowed from December 22, 2021 until January 18, 2022. This includes New Year’s Eve parties, weddings receptions, funeral receptions and other life events or celebrations.

- Indoor events at venues can only have 50% capacity, no matter the size. This includes events like concerts, sports or movies.

- Everyone age 12 and older must be fully vaccinated to attend. Use the BC Vaccine Card to show proof of vaccination.

- Venues must scan the BC Vaccine Card QR code.

- Outdoor organized seated gatherings can have a capacity of 5,000 people or 50% capacity, whichever is greater.

Follow any additional measures that may have been put in place by local public health or in your health region.

- Learn more about the current provincial restrictions

Event organizers should also review the PHO Order on Gatherings and Events.

Visit the BCCDC website to find information on the following:

- New Year’s Eve parties

- What’s the guidance for weddings in Step 3?

- Where can I find information about community-based events?

- Where can I find information about participating in assemblies, protests and rallies?

- COVID-19 Precautions

Other Resources:

August 23, 2021

A new order from the provincial health officer will require individuals to provide proof of vaccination to access a broad range of social, recreational, and discretionary events and businesses throughout the province.

As of Sept. 13, one dose of vaccine will be required for entry to these settings. By Oct. 24, entry to these settings will require people to be fully vaccinated at least seven days after receiving both doses.

A secure weblink will be provided and publicized before Sept. 13, where people will be able to confidentially access their proof of vaccination. Individuals will be able to save a copy of their proof of vaccination to their phone to show it when entering or using designated businesses and events. Individuals who cannot access their proof of vaccination online will be provided with a secure alternative option.

- As of Sept. 13, people in British Columbia will be required to be partially vaccinated with at least one dose of a COVID-19 vaccine to access certain businesses and events.

- As of Oct. 24, people in British Columbia will be required to be fully immunized, at least seven days after receiving two doses of COVID-19 vaccine, to access the same list of businesses and events.

- In the interim, in areas where community transmission is increased significantly or where there are outbreaks, the requirements to be fully vaccinated to access these events and activities may be required at the direction of the local medical health officer.

- Here is the full list of settings where proof of vaccination will be required:

- indoor ticketed sporting events

- indoor concerts

- indoor theatre/dance/symphony events

- restaurants (indoor and patio dining)

- night clubs

- casinos

- movie theatres

- fitness centres/gyms (excluding youth recreational sport)

- businesses offering indoor high-intensity group exercise activities

- organized indoor events (eg. weddings, parties, conferences, meetings, workshops)

- discretionary organized indoor group recreational classes and activities

- Individual businesses or event organizers may also implement these requirements earlier as part of their ongoing safety plans. Businesses or institutions choosing to adopt their own vaccination policies beyond those set out in this order will be responsible for doing their own due diligence.

- Individuals will be able to confidentially access their proof of vaccination through a secure website. A weblink will be provided and publicized widely before Sept. 13. To access proof of vaccination an individual will need:

- name

- date of birth

- personal health number (PHN)

- Individuals will be able to save a copy of their proof of vaccination to their phone to show when entering or using designated businesses and events.

- A second, secure option will be provided for people who cannot access their proof of vaccination online through a call-in centre (call centre details to be made public in coming days).

- Individuals will show proof of vaccination in the settings listed in the PHO order, alongside valid government ID.

- Proof of vaccination will also be required for people visiting from outside of B.C. using a provincially/territorially recognized official record alongside valid government ID from the jurisdiction. For individuals visiting from outside of Canada, they will be required to show their proof of vaccination used to enter the country and their passport.

- The measures will be time limited through to Jan. 31, 2022, subject to possible extension.

- The measures set out above do not apply to K-12 schools (public and independent) and before-and-after school programs for students. Student-only events and activities within K-to-12 public and independent schools and before and after school programs are excluded from providing a proof of vaccine as they will be covered by specific guidelines for school and child care settings. Guidance for these settings related to students will be provided in the coming days. The measures do apply to large indoor events (theatre, concerts) attended by parents, family and/or the public.

- The measures set out above will, as relevant, apply to post-secondary campuses. Student housing will be a part of the public health order identifying where proof of vaccination is required and will be in effect for Sept. 7. Further guidance for these settings related to students will be developed in the coming days in consultation with public health, including which types of student housing facilities will be included.

WORKPLACE SAFETY

The Vaccine Card announced today does NOT apply to workplace environments. To ensure your worksites remain safe and operational, access BCCSA COVID-19 Resources for information and best practices protocol.

June 29, 2021

At 1:45pm on June 29, the Premier of BC announced the move to Step 3 of BC’s Restart Plan and for businesses to transition from COVID-19 Safety Plans towards Communicable Disease Prevention Plans.

Remember that the journey of this pandemic is not over. Immunization is a mitigation strategy, not a cure. Please ensure you adhere to good hygiene protocols (e.g. handwashing) and safety protocols.

June 24, 2021

VACCINE FAST TRACK FOR CONSTRUCTION WORKERS – First Dose Only

BCCA

BC’s first COVID-19 vaccine “fast lane” for construction workers has been organized by BCCA. Starting this week, any workers in our industry can just show up at these clinics on designated dates and times to get their first dose:

Lower Mainland: (June 24, 25, 30, July 8, 9) 1:30 to 4:30 PM

Vancouver – Italian Cultural Center (3075 Slocan St.)

Burnaby – The Christine Sinclair Community Centre (3713 Kensington Ave.)

Abbotsford – Abbotsford Ag Rec (32470 Haida Dr., Building 1)

No pre-registration is needed. Government ID or a Provincial Health Number is not necessary, but bringing it will speed up the vaccination experience. *First dose only, wear your hard hat or bring your site access card or other construction ID.

June 17, 2021

Employer reimbursement program launches for COVID-19 paid sick leave

Government of BC

Starting Thursday, June 17, 2021, employers can apply for reimbursement of wages paid to workers who have taken sick leave related to COVID-19.

The temporary reimbursement program is retroactive to May 20, when legislation was passed, to ensure sick workers can stay home for up to three days without losing wages, while supporting businesses during the pandemic.

To apply for reimbursement, employers must be registered for WorkSafeBC compensation coverage and signed up for WorkSafeBC’s online services. Employers will be required to complete a short online form that collects information about their employees’ COVID-19 related sick leave. Once submitted, processing of the application and payment by electronic transfer can take up to 10 business days.

May 25, 2021

B.C. launches restart plan to safely bring people back together.

Government of BC

The step-by-step plan will follow approximate timelines and will ease people and businesses slowly out of the pandemic.

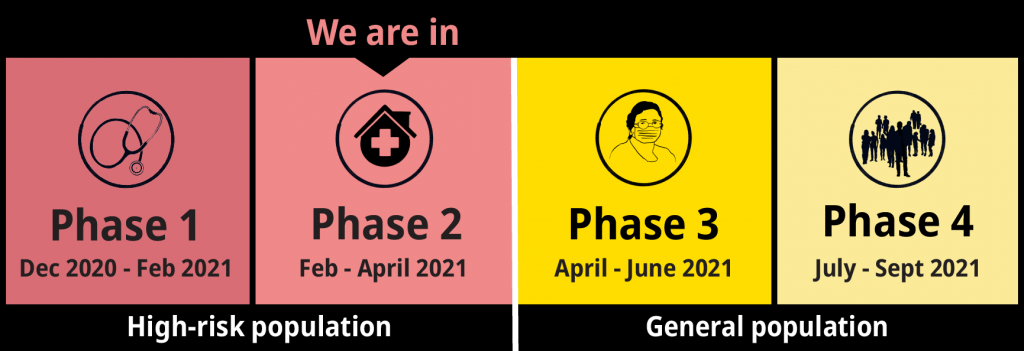

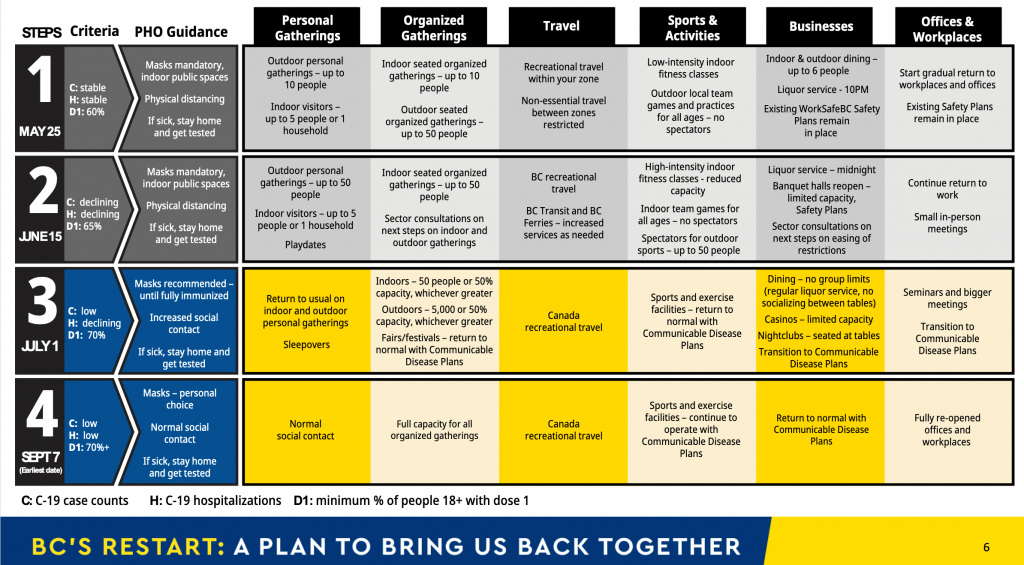

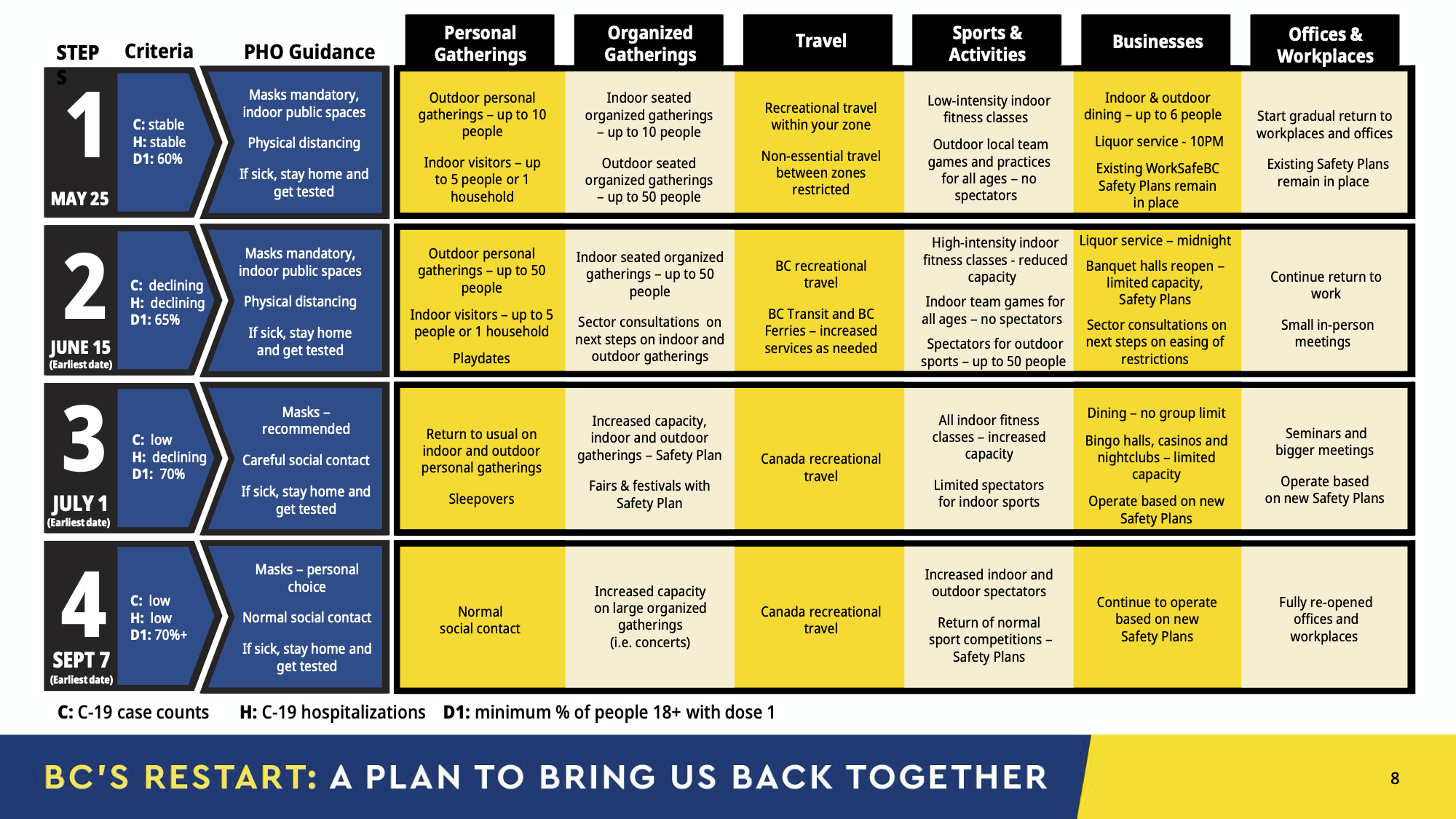

The four steps are:

The four steps are:

Step 1: May 25

- 60% of adult population with Dose 1

- COVID-19 cases stable, hospitalizations stable

- Maximum of five visitors or one household allowed for indoor personal gatherings

- Maximum of 10 people for outdoor personal gatherings

- Maximum of 10 people for seated indoor organized gatherings with safety protocols

- Maximum of 50 people for seated outdoor organized gatherings with safety protocols

- Recreational travel only within travel region (travel restrictions extended)

- Indoor and outdoor dining for up to six people with safety protocols

- Resume outdoor sports (games) with no spectators, low-intensity fitness with safety protocols

- Start gradual return to workplaces

- Provincewide mask mandate, business safety protocols and physical distancing measures remain in place

- Return of indoor in-person faith-based gatherings (reduced capacity) based on consultation with public health

Step 2: Mid-June (June 15 – earliest date)

- 65% of adult population with Dose 1

- Cases declining, COVID-19 hospitalizations declining

- Maximum of 50 people for outdoor social gatherings

- Maximum of 50 people for seated indoor organized gatherings (banquet halls, movie theatres, live theatre) with safety protocols

- Consultation process to prepare for larger indoor and outdoor gatherings with safety protocols

- No B.C. travel restrictions – check local travel advisories

- Indoor sports (games) and high-intensity fitness with safety protocols

- Spectators for outdoor sports (50 maximum)

- Provincewide mask mandate, business safety protocols and physical distancing measures remain in place

Step 3: Early July (July 1 – earliest date)

- 70% of adult population with Dose 1

- Cases low, COVID-19 hospitalizations declining

- Provincial state of emergency and public health emergency lifted

- Returning to usual for indoor and outdoor personal gatherings

- Increased capacity for indoor and outdoor organized gatherings, with safety plans

- Nightclubs and casinos reopen with capacity limits and safety plans

- New public health and workplace guidance around personal protective equipment, physical distancing and business protocols

Step 4: Early September (Sept. 7 – earliest date)

- More than 70% of adult population with Dose 1

- Cases low and stable (contained clusters), COVID-19 hospitalizations low

- Returning to normal social contact

- Increased capacity at larger organized gatherings

- No limits on indoor and outdoor spectators at sports

- Businesses operating with new safety plans

Read more: https://news.gov.bc.ca/releases/2021PREM0037-001008

This order takes effect today, April 23, and is in place until May 25 at midnight.

Since first learning about the government’s intentions to impose these regional travel restrictions, CHBA BC has been ensuring that the essential work of the residential construction industry was considered and exempted by the Ministry of Public Safety, prior to any final decisions made. As outlined on the B.C. government’s website, this order specifically targets travel for:

- Vacations, weekend getaways and tourism activities

- Visiting family or friends for social reasons

- Recreation activities

The website also details a comprehensive list of what is considered reasons for essential travel. Of the essential reasons listed, work and carrying out work-related purposes (paid and unpaid) and the transportation of commercial goods, is identified. As a result of this exemption, CHBA BC believes its members and their related, necessary work to complete projects are not affected by this order.

The goal of this new measure is education and further discouraging people from travelling for non-essential reasons. In the coming days, the Province will work with other groups to enforce the order, which includes working with the police to establish periodic road checks at key travel corridors during times associated with leisure travel in order to remind travellers of the order. If compliance measures are deemed necessary by police, fines in the order of $575 can be handed out.

CHBA BC continues to remind members to remain vigilant in following COVID-19 safety protocols on their worksites and can review these on CHBA BC’s COVID-19 Information and Resource page.

For more information on the order, its enforcement and regional zones, please review the B.C. government’s news release and the COVID-19 travel restrictions website.

April 19, 2021

This afternoon, B.C. Premier John Horgan announced the government’s intentions to impose new regulations that will prohibit non-essential travel outside of one’s regional health authority. The Public Safety Minister, Mike Farnworth, is expected to issue an order on Friday under the Emergency Program Act and specific details on how this will be implemented are expected to come forward prior to then.

At this time, it has been indicated by the Premier that random roadside checks would be in place and that fines could be issued if one is travelling outside of their health region, without a legitimate reason. Additionally, signs will be placed along the Alberta border to remind travellers entering the province should not be there unless it for essential business purposes.

At this time, CHBA BC is seeking clarity from the Ministry of Public Safety on how this measure applies to the work of members within the residential construction industry. Specifically, CHBA BC is seeking clarification on how essential travel and business are defined and how workers travelling to work sites will need to demonstrate proof of essential travel.

ESSENTIAL TRAVEL

Individual circumstances may affect whether a trip is considered essential or non-essential. Essential travel within B.C. includes:

HEALTH AUTHORITY BOUNDARIES

Search by community list or by the map (for may view, scroll to the bottom of link).

Any members with concerns on how this forthcoming public health order will impact their workers’ abilities to travel to a worksite are strongly asked to speak to CHBA BC’s Director of Policy and Government Relations, Carmina Tupe, as soon as possible to help ensure considerations are made for the residential construction industry prior to the order taking effect. Carmina can be contacted by phone at 647-326-6181 or via email at carmina@chbabc.org.

Until specific rules are defined, it is strongly recommended that members provide their workers with documented proof of the location of their worksite, if they are required to work outside of their Health Authority.

April 9, 2021

As announced yesterday by the Provincial Health Officer, Dr. Bonnie Henry, WorksafeBC has been empowered to shut down businesses, and or work sites for as long as ten (10) days should it be determined that three (3) positive COVID-19 cases are attributed to stemming from any particular place of business, and or work site.

Attention all members: REVIEW AND UPDATE YOUR COVID-19 SAFETY PLAN.

It is vital at this time, as vaccines are rolling out, that members continue to be vigilant, and provide and enforce all COVID protocols to stem the potential spread of C19 and the highly contagious variants. It is important for the health and safety of your families, your staff, friends and colleagues, and yourself. Please note that being shut down might seem hard, but by the time WorksafeBC has enough data/evidence to force a closure many others could be exposed, plus the legacy of such an order may have adverse consequences to the rates applied to your business by WorksafeBC moving forward.

We are in a race to vaccinate fast enough to stay ahead of the infection rate and that means maintaining and or enhancing your C19 safety measures already in place.

For more information on the most recent PHO order and how to keep workplaces healthy and safe, please refer to the following:

- The Ministry of Health for more information about the PHO order

- Your regional health authority for information about specific closure orders

- WorkSafeBC’s COVID-19 website for resources and information on keeping workplaces safe, including information on the PHO order on our Inspections and consultations during the COVID-19 pandemic page

- REMINDER: Guidance to Construction Sites operating during Covid-19, issued by the PHO on April 27, 2020, remains active and mandatory.